Amateur investors and traders often look to the legends for inspiration. Warren Buffett and Ray Dalio are well-known for consistently profiting from their investments over the long term. Traders like George Soros and Paul Tudor Jones rely on more frequent buying and selling strategies, which defines trading. These professionals have made a living off the traditional stock markets and set standards that investors in newer markets, like cryptocurrencies, hope to emulate or beat.

Investors and traders are aligned in their goal of wanting to increase their investment value. However, investing and trading employ very different strategies despite some intertwining. Broadly put, investors buy cryptocurrencies with strong fundamentals, and believe the price will appreciate over the long term. Traders, on the other hand, hold onto cryptocurrencies for a short period, and leverage on the market volatility to generate profits.

We’ll look into major differences between investing and trading cryptocurrencies to help you decide which strategy serves you better.

What Is Cryptocurrency Investment?

Investing in cryptocurrencies is a strategy to profit by buying and holding cryptocurrencies over a longer time horizon in the hope that the investment will appreciate in value. This is similar to the value investing method used by Warren Buffet, whereby investors look for underpriced cryptocurrencies.

Cryptocurrency investment is also referred to as HODLing — a misspelling of “holding” that has since caught on with the acronym, “hold on for dear life.” Investors who HODL believe in the fundamentals of the cryptocurrencies they buy, disregarding short-term market fluctuations.

What Is Cryptocurrency Trading?

Timing the market refers to buying or selling an investment based on predicting the best entry or exit point. It’s akin to believing you have a crystal ball that can tell you which way the market will go. With that kind of confidence, you’d be willing to wait for lower entry levels into an investment, or higher selling levels. Traders use market timing strategies.

Trading cryptocurrencies involves short-term strategies that make the most of price and market fluctuations. Usually, traders aren’t too concerned with the fundamentals of a cryptocurrency, instead speculating on the short-term price movements of a cryptocurrency to make a profit, often within the day. Traders often follow market news and make use of technical indicators to arrive at their trading decisions. Despite the potential to generate overnight profitability, trading cryptocurrencies usually carries risk and requires a lot more effort, as compared to investing.

Differences Between Cryptocurrency Investing (HODLing) and Trading

As mentioned, investing and trading are intertwined. Sometimes, the two terms are casually and interchangeably used. After all, traders can make investments, and investors can trade, too. The difference between investing and trading can be somewhat nuanced. To help you decide which strategy better suits you, we’ll analyze the differences between investing and trading, referencing a few key factors.

Investment Time Frame and Period

A critical difference between cryptocurrency investing and trading is in the time frame.

Cryptocurrency Investing: This is typically a long-term strategy. Investors or HODLers believe in the long-term potential of their cryptocurrencies and their future price appreciation. Investors minimize trading on short-term price movements, and hold on to their cryptocurrencies for periods that can last up to years, requiring a fair bit of patience.

Timing the markets is challenging within any asset class, let alone volatile markets like cryptocurrencies with their quick-moving price swings. The danger of waiting to time the market means you may instead miss a trade entirely. In general, longer-term crypto investors don’t try to time markets or look to profit off of trends. The tide that lifts more boats is more important than catching the specific wave that may propel a single trade higher.

Cryptocurrency Trading: This is a short-term strategy. Traders leverage the short-term volatility of cryptocurrencies, and profit by speculating on the price action. There are different time frames for trading, ranging from seconds to hours to weeks. Cryptocurrency trading can be very profitable, given the high volatility of cryptocurrencies.

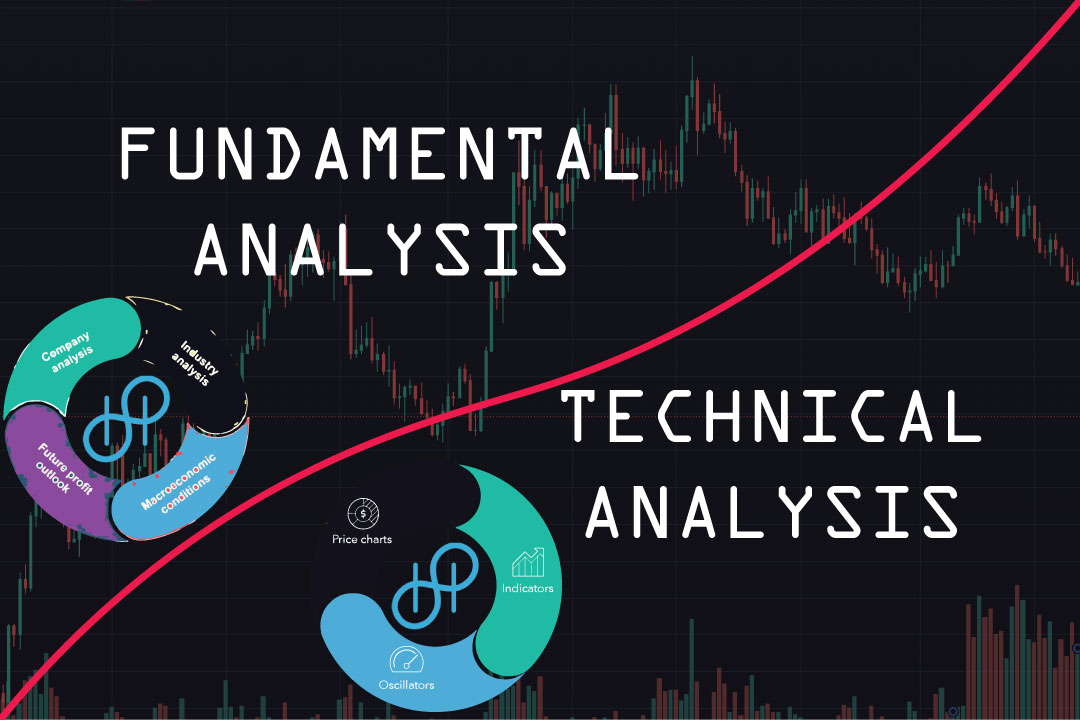

Type of Analysis

Analysis refers to the methods and tools that investors use to evaluate investments, and traders use to spot profitable trading opportunities. Given that investors and traders look at different time horizons and evaluate different factors, the type of analysis employed by each group will differ significantly. The two main frameworks are fundamental analysis and technical analysis.

Cryptocurrency Investing: Investors typically perform fundamental analysis on cryptocurrencies. Since investors take a long-term bet on a cryptocurrency’s value, its fundamentals become a core component in evaluating its potential. Given that there are no publicly available financial statements for cryptocurrencies, crypto fundamental analysis is vastly different from that applied to traditional stocks.

Here are some of the metrics that an investor can use to establish the intrinsic value of a cryptocurrency when they perform fundamental analysis:

- Underlying technology

- Tokenomics: Token emissions, rewards, security incentives

- Developer background

- Third-party software integrations

- Number of users

- Market adoption rate

Cryptocurrency Trading: Technical analysis is widely used by traders. Their goal is to forecast the future price direction and market positioning, obtained by analyzing historical data with various technical indicators and charting tools. Since the price movements of cryptocurrencies can be unpredictable and eccentric, traders require deep knowledge of technical analysis in order to time the market and profit from price volatility.

Risk Profile

Cryptocurrencies are inherently volatile — and therefore high-risk. To venture into cryptocurrency investing or trading, this risk is essential to understand. The term “risk tolerance” means the degree of risk an investor is willing to take. Bear in mind that higher risk is also potentially related to greater rewards, known as the risk-to-reward trade-off.

While cryptocurrencies (whether you’re trading or investing) are notoriously risky because of their high volatility, investors and traders can still be differentiated by their risk appetites.

Cryptocurrency Investing: Investors generally have less tolerance for risk, and are thus more comfortable with leaving their investments alone. They’re not as concerned with daily price volatility. The central idea of investing is that, over the long term, a cryptocurrency’s volatility will smooth out and the crypto’s price will still follow an upward trend.

Cryptocurrency Trading: Traders are risk-takers who require a good grasp of market volatility and conditions. They will eventually make trades after studying indicators and signals, and can make money by exploiting the high volatility of short-term crypto prices. Of course, traders can lose just as much if they “back the wrong horse.”

Margin trading, the practice of borrowing funds from other parties to trade, significantly raises the risk for traders, since they can lose much more than their original funds. Thus, risk management remains crucial, especially in the crypto market.

Trade Frequency

Another significant difference between cryptocurrency investing and trading is how often trades are executed. Trade frequency is inversely correlated to the period of an investment. The longer an investment period, the lower the trade frequency.

Cryptocurrency Investing: Investors typically have a low trading frequency, as they tend to hold on to their assets without selling. Their investment goals may stretch over a few years, so they don’t need to be actively involved in the day-to-day market — and are generally not affected by short-term volatility. Investors can build their wealth over time without having to fret over daily market movements.

Cryptocurrency Trading: Traders, on the other hand, trade frequently. This is because they’re constantly looking at market price movement for opportunities to make gains, no matter how small. This high frequency potentially makes trading more lucrative, but it’s riskier, requires continuous and active monitoring of the market, and involves higher costs because of the greater number and frequency of trades.

Profit

The methods by which investors and traders can profit differ, due to differing strategies.

Cryptocurrency Investing: The profit an investor receives is very straightforward, mainly in the form of price appreciation. The formula is simple: Profit = Selling Price − Buying Price – Cost of Investment (i.e. trading fees)

Cryptocurrency Trading: Trading can be very lucrative, since traders profit off the price fluctuations in the market. Traders also have the option of using leverage, which can magnify their profits with little initial capital. Note that using leverage also increases a trader’s risk.

One important difference between investing and trading is that traders can profit in either a bull or bear market. They can long in a bull market and short in a bear market. However, this strategy isn’t possible for cryptocurrency investors, who have to wait out bear markets.

Nonetheless, there are other forms of profits for cryptocurrency investors, like airdrops and capital gains from staking and yield farming. These usually aren’t available to traders, who don’t hold onto a cryptocurrency long enough to take advantage of these opportunities.

Costs and Capital Required

Costs incurred for participating in cryptocurrency markets can be broadly classified into exchange fees and network fees. Cryptocurrency exchanges charge fees for providing services such as trading, deposits, withdrawals and liquidations, among others. Network fees go to the miners who secure the networks.

Cryptocurrency fees vary across exchanges, but on average, most exchanges charge between 0.1% to 1% per trade.

Due to the higher frequency of cryptocurrency trading (as compared to investing), traders usually have to pay more transaction fees. In addition, traders are subject to capital gains tax, which has to be paid on each asset that’s sold for short-term profit. Investors are subject to fewer charges, given that they make fewer and less frequent transactions.

Capital requirements for both trading and investing depend on the investment sizes desired. You can begin trading or investing in crypto with virtually any amount, large or small.

Profit Diversity

Investors can simultaneously use both longer-term investing and shorter-term trading strategies. This approach provides diversification in your investment strategy, as well as additional ways to profit. Similarly, a trader might also have a longer-term investment portfolio, although investors may not have as much time to trade or interest in doing so.

Cryptocurrency Investing Strategies

Here are the main cryptocurrency investing strategies:

-

HODL (“Hold on for dear life”): A strategy where an investor holds onto cryptocurrencies indefinitely. The concept behind this strategy is based in the belief that cryptocurrency prices will continue to rise significantly in the long term.

-

Dollar-Cost Averaging (DCA): With this strategy, investors invest a small amount into cryptocurrencies at regular intervals, regardless of market conditions. At times, investors will purchase cryptocurrencies at a higher price, and at other times, a lower price. Over time, the price theoretically averages out. This approach has been proven to reduce the impact of market volatility on one’s portfolio over the long term. Dollar-cost averaging helps investors steer away from both FOMO (fear of missing out) and FUD (fear, uncertainty and doubt).

- Market Cap–Weighted Portfolio: This is a strategy whereby your portfolio holdings are periodically rebalanced. Cryptocurrencies that have appreciated will be sold at a higher price, while underperforming cryptocurrencies are purchased at a lower price. By using this strategy, an investor can prevent their portfolio from becoming too concentrated in one particular cryptocurrency, and can generate greater appreciation over time.

Cryptocurrency Trading Strategies

There are multiple strategies that cryptocurrency traders can employ.

-

Day Trading: Day traders conclude trades within a day, and rarely hold overnight positions. They constantly monitor the market, taking advantage of intraday price movement for daily profit. The time duration for each trade ranges from minutes to hours.

-

Scalping: Scalping is one of the more fast-paced trading strategies. It involves buying and selling coins on minimal price movements. Scalpers are the most active traders. They execute several trades to make a small profit from each transaction, and capitalize on increased trade volume, which can add up substantially at the end of the day. Scalping trades are short, lasting minutes or even seconds. Scalpers make many trades daily, and try to “skim” a profit without holding positions for long.

-

Momentum Trading: Momentum traders execute trades based on the strength of recent price trends. They jump on a price trend and aim to “ride the wave,” buying low in an upward trend and selling once the price breaks momentum (and vice versa). They aim to take advantage of broader uptrends and downtrends, hoping that the direction of the asset will maintain its momentum. Momentum traders need to have a fairly good sense of timing, and the ability to read the market. A momentum trade can take anywhere from an hour to weeks to enter and exit.

-

Swing Trading: This technique takes advantage of a cryptocurrency’s short-term price swings, with a trade typically lasting between a day and a few weeks. Swing traders use technical analysis to predict large movements in cryptocurrency prices in a particular direction within a short period. The time frame for a swing trade is generally a bit longer or intermediate-term than that for a momentum trade.

-

High-Frequency Trading (HFT): This is an algorithmic trading strategy usually used by quant traders. Algorithms and trading bots can help traders quickly enter and exit a cryptocurrency trade.

-

Position Trading: This form of trading leans toward investing. It’s similar to swing trading, but typically requires a deeper analysis of long-term trends. A position in this trade can be held for months before being closed.

Alternatives to Investing and Trading

Trading and investing aren’t the only ways to make money with cryptocurrencies. Following are some of the alternatives.

Cloud Mining: Cloud mining uses cloud computing power to mine cryptocurrency, so you don’t have to own or install the hardware and run related software. Firms that offer cloud mining services allow you to open an account and remotely mine crypto for a fee. You participate in a mining pool by purchasing a certain amount of hash power, and earn a share of the profits proportional to the amount of hash power you’ve paid for).

Are You an Investor — Or a Trader?

Trading and investing are different approaches to profiting in the cryptocurrency market. Deciding which one is better for you depends on your risk appetite and time availability.

If you’re comfortable with taking on frequent risks, and have the capacity to monitor markets constantly, trading might just be the right strategy for you. If you prefer a more laid-back approach, then consider investing for the long term. Doing a bit of both is also an option.

Closing Thoughts

The cryptocurrency market is as exciting as it is volatile — so tread with caution. Understand the key differences between cryptocurrency investing and trading crypto before deciding which approach best suits you.

Ultimately, a smart investor recognizes the different parts of market cycles in order to take advantage of market conditions, and HODL in the hope that the asset’s price will appreciate. In contrast, traders tend to profit from short-term price movements in a bull or bear market. Still, both investors and traders need to deploy a proper risk management system and a contingency plan to exit the market when it goes in an unfavorable direction.

source: bybit