In the ever-evolving world of forex trading, understanding the intricacies of both fundamental and technical analysis is paramount to success. These two pillars of analysis provide traders with the tools and insights needed to make informed decisions in the highly volatile forex market.

Unlocking the Forex Market: Fundamental Analysis

What is Fundamental Analysis?

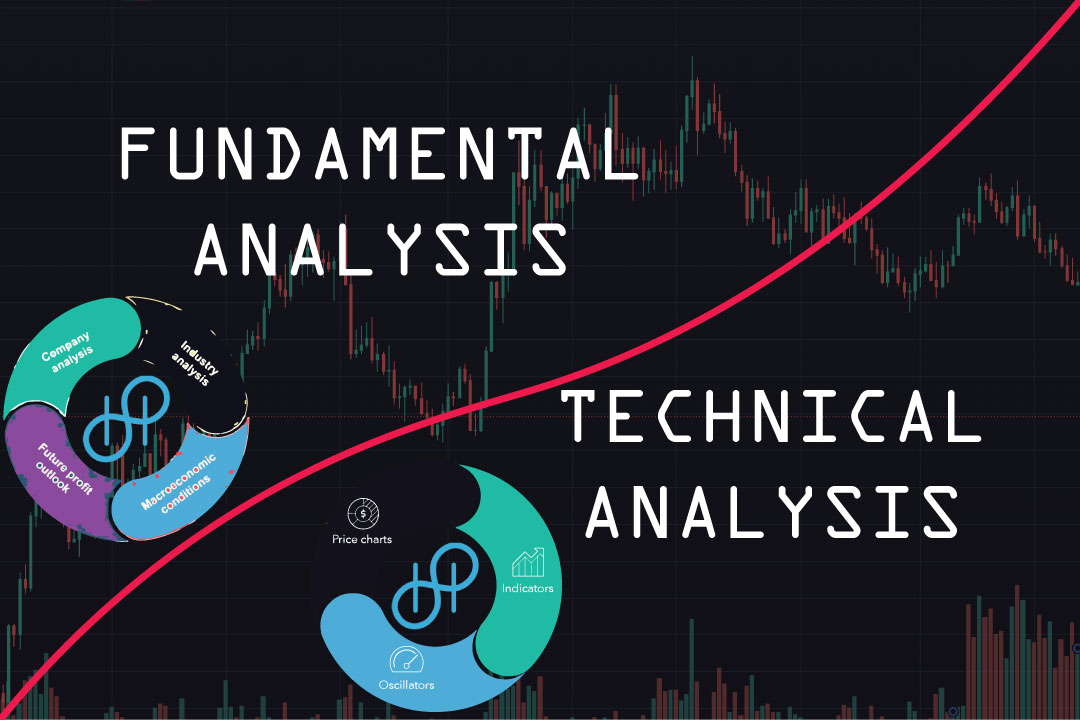

Fundamental analysis in forex revolves around the examination of economic, political, and social factors that influence currency values. It delves into the heart of a nation’s economic health and its global standing. Key components of fundamental analysis include:

- Economic Indicators: These encompass a range of data such as GDP growth, employment figures, and inflation rates. Traders use these indicators to gauge a country’s economic performance.

- Political Stability: Political events and stability play a crucial role in currency value. A nation with stable governance often has a stronger currency.

- Interest Rates: Central banks’ policies and interest rates have a significant impact on forex markets. Higher interest rates can attract foreign capital, increasing demand for the local currency.

The Power of News and Events

Fundamental analysis involves keeping a close eye on news and events that can move the markets. Major economic announcements, geopolitical developments, and even natural disasters can sway currency values. Savvy traders stay informed and use this knowledge to their advantage.

Decoding Forex Trends: Technical Analysis

Understanding Technical Analysis

On the other side of the spectrum, we find technical analysis, which focuses on historical price data and charts. Traders who utilize technical analysis believe that historical price movements can help predict future trends. Key aspects of technical analysis include:

- Candlestick Patterns: Recognizing candlestick patterns can provide insights into potential trend reversals or continuations.

- Support and Resistance Levels: Identifying these levels on a price chart can help traders make informed decisions about entry and exit points.

- Indicators and Oscillators: Tools like Moving Averages, Relative Strength Index (RSI), and MACD (Moving Average Convergence Divergence) assist in making sense of price data.

The Art of Chart Analysis

Technical analysts spend hours dissecting price charts, identifying patterns, and plotting indicators. Through meticulous analysis, they aim to predict where the market might be headed next.

Combining Forces for Success

Successful forex traders often combine both fundamental and technical analysis to make well-rounded decisions. By integrating these approaches, traders gain a more comprehensive understanding of the market’s dynamics.

In Conclusion

In the competitive world of forex trading, mastering both fundamental and technical analysis is essential. Fundamental analysis equips traders with insights into the broader economic landscape, while technical analysis helps decode price movements. By harnessing the power of these two approaches, traders can navigate the forex market with confidence and increase their chances of success.